MMT, U.S. Inflation, and Supply-chain Restrictions

Can MMT dodge the high inflation challenge using supply chain restrictions?

Simply put, for modern monetary theory (MMT), a country can monetize large deficits if (1) it’s able to issue debt denominated on its own currency and (2) issues a world-reserve (fiat) currency. The U.S. meets these requirements and yet is going through the highest inflation rate in four decades. Current inflation levels in the U.S. should pose a challenge to MMT advocates.

Prof. Kelton, a representative voice of MMT, argues that the MMT “paradigm” remains uncontested by the recent spike in inflation.

Kelton’s defense of MMT is quite curious. After admitting that on “one level,” she thinks “it’s fair to say that policymakers did experiment with MMT,” she then argues that MMT is “of course” not to blame; MMT economists are. It seems that for Kelton, MMT economists in the field do not understand MMT. I would add that, seeing some of the interactions between advocates and critics of MMT, only MMT advocates understand MMT.

Inflation: Demand or Supply Driven?

If inflation is not demand-driven, it must be supply-driven. This is where the supply-chain explanations of inflation come in. However, I see two problems in explaining the recent spike in inflation with a supply-chain (real shock) argument.

First, a supply chain shock should produce a one-time change in the price level. The more inflation looks permanent over transitory, the more difficult it becomes to explain inflation with a real shock. A permanent inflation rate needs a permanent worsening of the supply chain.

Second, nominal shocks have long and varying lags over the price level. Real shocks, on the contrary, have a short-term effect on the price level. When there is a natural disaster, the price level rises immediately, not a year and a half later. Covid-19 effects and lockdowns started in early 2020, not in the last few months. Timing does not work very well.

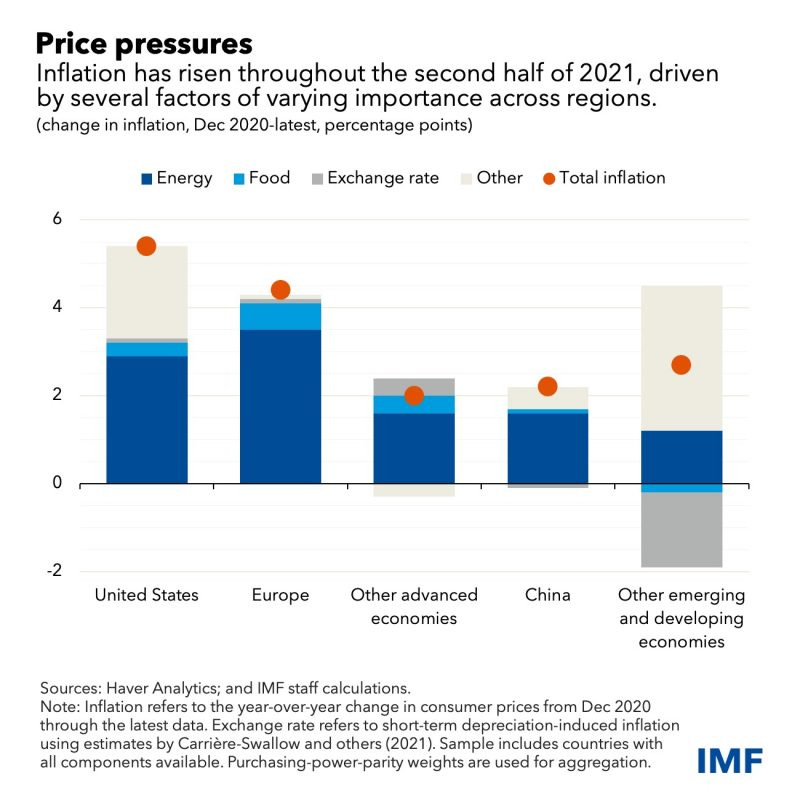

This is not to say that supply-chain problems play no role in the recent inflation rates. This is to point out that relying exclusively on a supply-chain explanation looks like a forced fit. The following chart from the IMF shows that the U.S. had a higher inflation rate than other countries and regions. Given the worldwide reach of Covid-19, the data suggests that there is something specific to the U.S. driving the higher inflation rate. Supply-chain problems are a worldwide issue, not just a U.S. condition.

If supply shocks are not enough to explain inflation, then aggregate demand shocks have a role to play. This is where the different rounds of stimulus plans are important. All those checks and subsidies sent to households and firms since early 2020 were initially hoarded (excess savings) because of uncertainty surrounding stay-at-home orders and job insecurity. With a more stable job market in 2021, these extra savings started to be spent, finally driving prices up. This narrative is plausible (I think) and maintains the link between monetary policy and inflation. The nuance here is that monetary policy seems to be channeled by the Treasury (a problem discussed in more detail here).

Economic policy does not happen in a vacuum; it takes place through a specific institutional constraint and channels. The institutional context is important to understand the lags and mechanisms through which policy will affect the economy.

The Green New Deal: Too Big to Pay?

MMT’s claim that the U.S. can spend a lot of money without worrying about inflation supports large projects such as the Green New Deal. As an MMT website puts it: “We Can Nice Things.”

Is the Green New Deal feasible, as MMT economists claim? Biden’s American Rescue Plan (enacted in March 2021), which delivers direct relief to the American people to “rescue” the economy and “beat” the virus, amounts to $1.9 trillion. In comparison, a low estimate of the tally of the Green New Deal rises to $51.1 trillion in a ten-year period. The Green New Deal amounts to 27 American Rescue Plans. If the amount of spending we have seen in the last two years gives is these high inflation rates, what will the Green New Deal do to the price level?

There is only so much moving the target and vagueness can do to protect the MMT “paradigm.”

More on MMT

More recently. supply driven inflation has been enhanced by demand driven inflation. The Fed can act to neutralize that "enhancement". In any case, the rise in inflation and the "discomfort" it brings, was a small price to pay to avoid a "deadly" depression that would have otherwise occurred.

https://marcusnunes.substack.com/p/a-21st-century-us-monetary-story