Argentina Celebrates a New Inflation Quinceañera

After 15 years of a rising trend of inflation, there are no signs of improvement in the short-run for Argentina's monetary disequilibrium.

The end year 2021 marks a new 15-year anniversary of high inflation in Argentina. I say new, of course, because it is not the first time Argentina goes through long periods of high inflation rates.

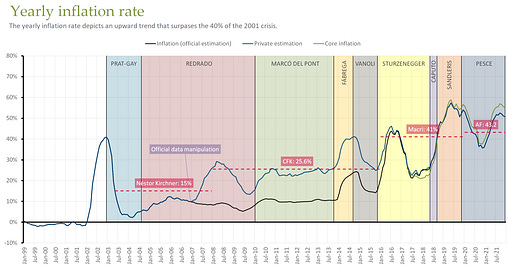

Argentina’s last period of high inflation starts in 2007, the same year the Kirchner administration decides to tamper with the official inflation rates (and by implication, with other indicators such as poverty rates and output). Between 2007 and 2016, the inflation rate is better captured by private estimations that were published by representatives of the opposition in Congress.1 The graph below shows the yearly inflation rate on a monthly basis (the colored columns are the central bank presidents).

Argentina shows that inflation can get out of control quite quickly. In 2006 the inflation rate was “just” 9.8%. The next year inflation reached 25.7%. In 2021 inflation reached a world record of 50.9%.

One lesson Argentina can teach the U.S. is how a country can go from monetary order to becoming a land of monetary disaster. As Emilio Ocampo explains, Argentina became a master in the application of modern monetary theory (MMT) principles so favored in some corners of U.S. politics. Argentina is a laboratory case of the long-run effects of MMT-inspired policies.

Let’s hope the U.S. does not repeat Argentina’s mistake so it does not get to celebrate its own “inflation quinceañera”.

The government threaten private firms that published inflation estimations with sizable fines and even jail time. To avoid these threats, it was Congress rather than private firms who announced an averaged estimation of the inflation rate. This became known as “Congress inflation” (Inflación Congreso).

Estados Unidos ya debió de subir la tasa de interés que maneja la Reserva Federal, por la excesiva inflación que tiene que bordea el 7%, pero las consecuencias económicas y políticas serían enormes, ya que el endeudamiento7pbi, a sobrepasado largamente a la que se tenía en la pre crisis del 2008