Is Argentine Disinflation Sustainable? (update)

In recent posts, I delved into the credibility of the Caputo-Milei economic plan, particularly on the disinflation process (see here and here). With the latest inflation figures for April released, it's time for a quick update.

The inflation rate

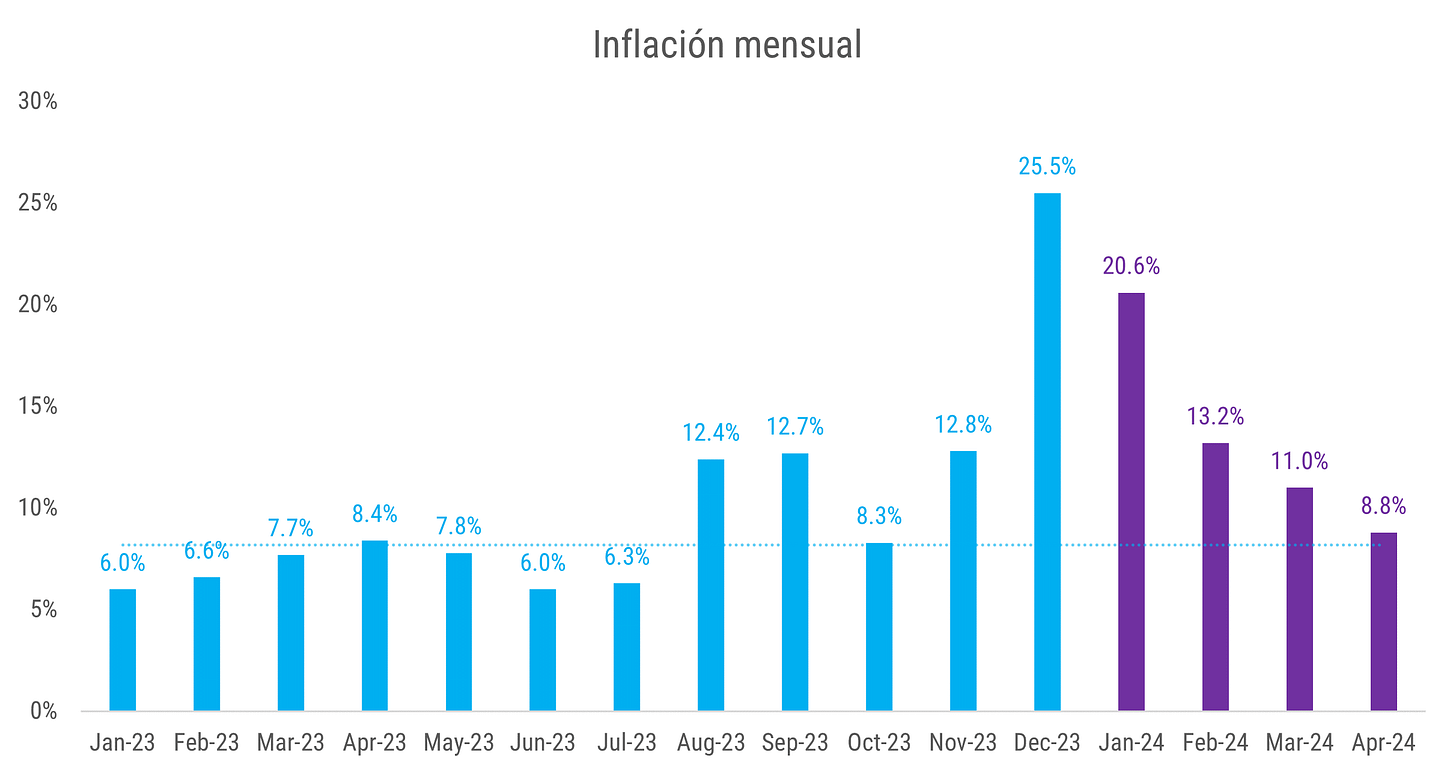

Let's begin with the inflation rate. In April, the monthly inflation rate dropped again to 8.8% (yes, this is a monthly figure). The graph below illustrates that the inflation rate has been declining since December 2023.

Note that the inflation rate has returned to its pre-campaign levels. The spike in inflation in November/December 2023 was due to Massa’s plan platita and December’s exchange rate depreciation (from 400ARS to 800ARS per USD). The up-down behavior in the inflation rate is the expected behavior once the plan platita and depreciation effects fade away. Relying solely on this disinflation as proof of the economic plan’s success is the oldest trick in the book. The real test lies ahead:

Will inflation dip below pre-campaign levels, and by how much?

If it does, what is the medium and long-run credibility? Can the 2% crawling peg resist these inflation rates?

Market surveys indicate a continued decline in the inflation rate, reaching 5.2% by October 2024 (p. 4). The year-end projection for 2024 is an inflation rate of 161.3% (p. 6), lower than 2023's 229.5% but still higher than 2022's 90.7%.

One crucial aspect not reflected in these numbers is price controls. The government has capped healthcare price increases and delayed until September some utility price adjustments. Will the government allow prices to adjust more rapidly, even at the cost of higher reported inflation? Or will it favor price controls to defer higher inflation rates?1

This disinflation comes with significant costs. Capital controls remain in effect (with rising rumors suggesting they may persist until 2025), and between November 2023 and February 2024, SA's economic activity plummeted by 9.96% (p. 5). Acknowledging that the alternative, potential hyperinflation, would have been more costly does not diminish the importance of considering the costs of disinflation, as they can shape future economic policies and their outcomes.

One last piece of information. In the first quarter, base money expanded by 55.8% (last year it did so by 3.1% in the same period). Argentina’s BM typically increases its expansion rate in the second half of the year. What happened? The central bank committed (to issue pesos) to buying government bonds to sustain the market price.

Fiscal and Budgetary Outlooks

The fiscal outlook is not as rosy as the government portrays. Yes, Milei announced a budget surplus for the first quarter of 2024 on national TV. But how was this achieved? The surplus largely stems from real adjustments in three areas (ranked by nominal amounts):

Reductions of social program disbursements (including pensions).

Cuts in capital expenditures (public investment).

Subsidies to the private sector.

These three areas account for 74% of all spending cuts (in real terms). The first and third items directly impact the private sector, particularly low-income households and individuals (item 1). Item 2 affects the private sector indirectly (i.e., providers to public investment and private contractors). How sustainable is this policy? The government still has a substantial number of voters who voted against Massa, not in favor of Milei - how much longer will these voters remain patient?2

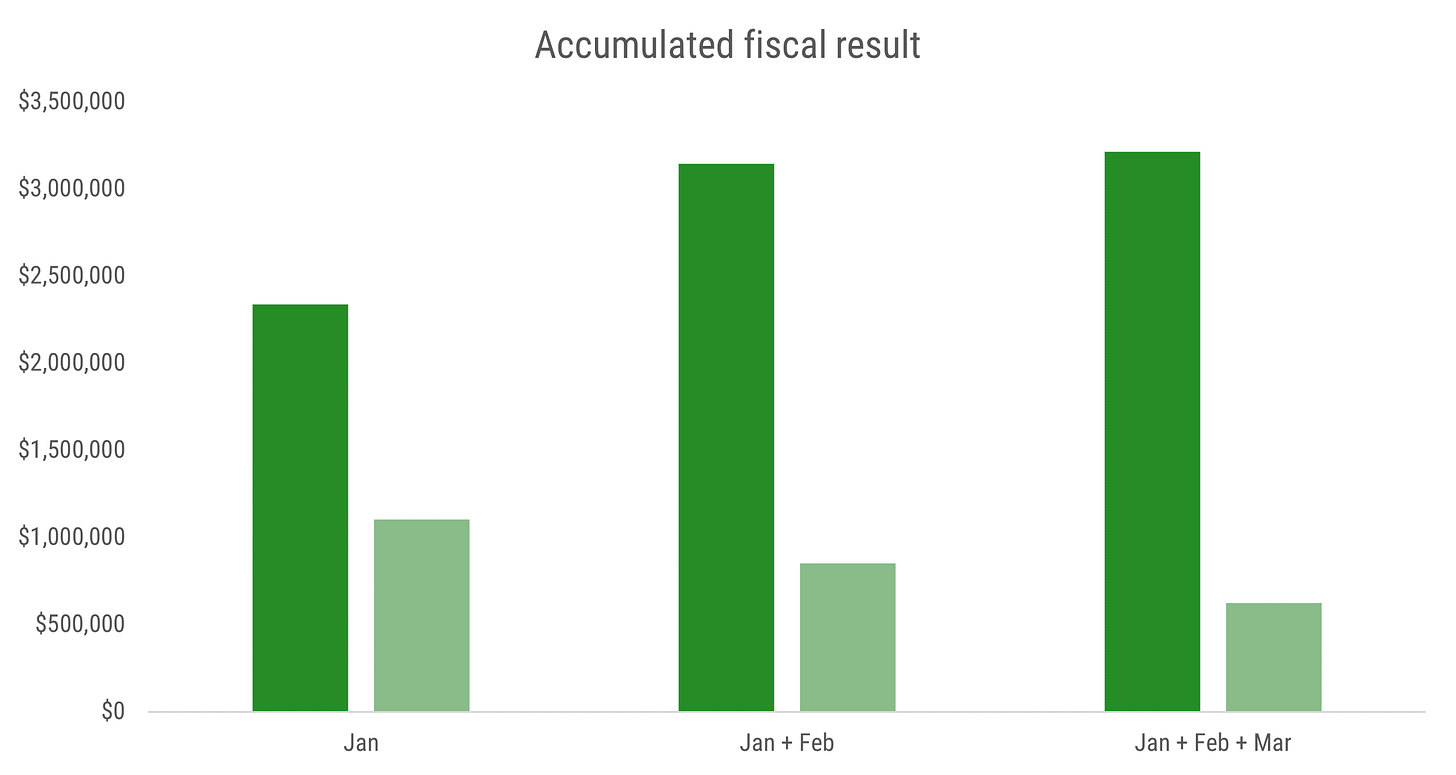

Another old trick at play is showing a surplus by deferring payments. Just as a chronic overspender can show a surplus by delaying bill payments, this is not a viable long-term solution for the government. The size of the government’s debt to the energy sector exemplifies this issue. When we consider the accrued-based budget rather than the cash-based one, the accumulated financial result (in nominal terms) is decreasing, indicating a financial deficit, not a surplus.

While fiscal results may improve in the coming months, the critical question is whether there are credibility concerns today that could undermine the economic plan’s stability. Ex-ante credibility concerns are an issue, even if ex-post the plan proves successful. Since fiscal deficits drive Argentina’s inflation, budgetary results’ credibility also affects inflation expectations.

While the incidence of these components in the index is limited, the amount of price adjustment that needs to take place is not. The accumulated inflation for 2024 is 67.4%. The accumulated inflation on electricity and healthcare providers is 261.6% and 141.8%. With public transportation prices (154.9%), these are the components with the highest variation in the CPI (based on Buenos Aires metropolitan area data).

Milei got 30% of the votes in the first round, collecting 55% in the second round. A simplistic (but informative) reading is that 25% of Milei’s votes are against Massa first and in favor of him second.