NGDP and Two Errors by the Federal Reserve

With the outbreak of Covid-19 the Fed committed two monetary policy mistakes, not just one (inflation).

Inflation is at its highest since the early 1980s. The most recent peak reached a yearly CPI inflation of 8.2%. The two previous peaks were 6.3% and 5.5% in October 1990 and July 2008. The Personal Consumption Expenditure Price Index (PCE) -Fed’s preferred index- also depicts a sharp increase in the last few months (grey line).

Keeping inflation under control is the responsibility of the central bank. The inflation rate is not only high by historical standards, but it is also above the Fed’s 2% AIT (average inflation target).1

The above chart invites the interpretation that the Fed has committed one mistake: allowing inflation to rise. However, looking at monetary equilibrium as the target of sound monetary policy shows that the Fed committed two errors.

Like any other market, monetary equilibrium means that the quantity of money demanded equals the quantity of money supplied. In terms of the equation of exchange, this means that MV is constant in per capita terms or, at least, follows a stable trend. And, since MV equals NGDP, monetary equilibrium also requires NGDP to at least follow a steady trend. In other words, the central bank’s job is to offset changes in V by adjusting M.

The Fed fails to maintain monetary equilibrium if NGDP deviates from its trend. There is an excess of money supply if M (money supply) grows faster than the fall in V (inverse of money demand). And there is a shortage of money supply if M falls less than the increase in V.

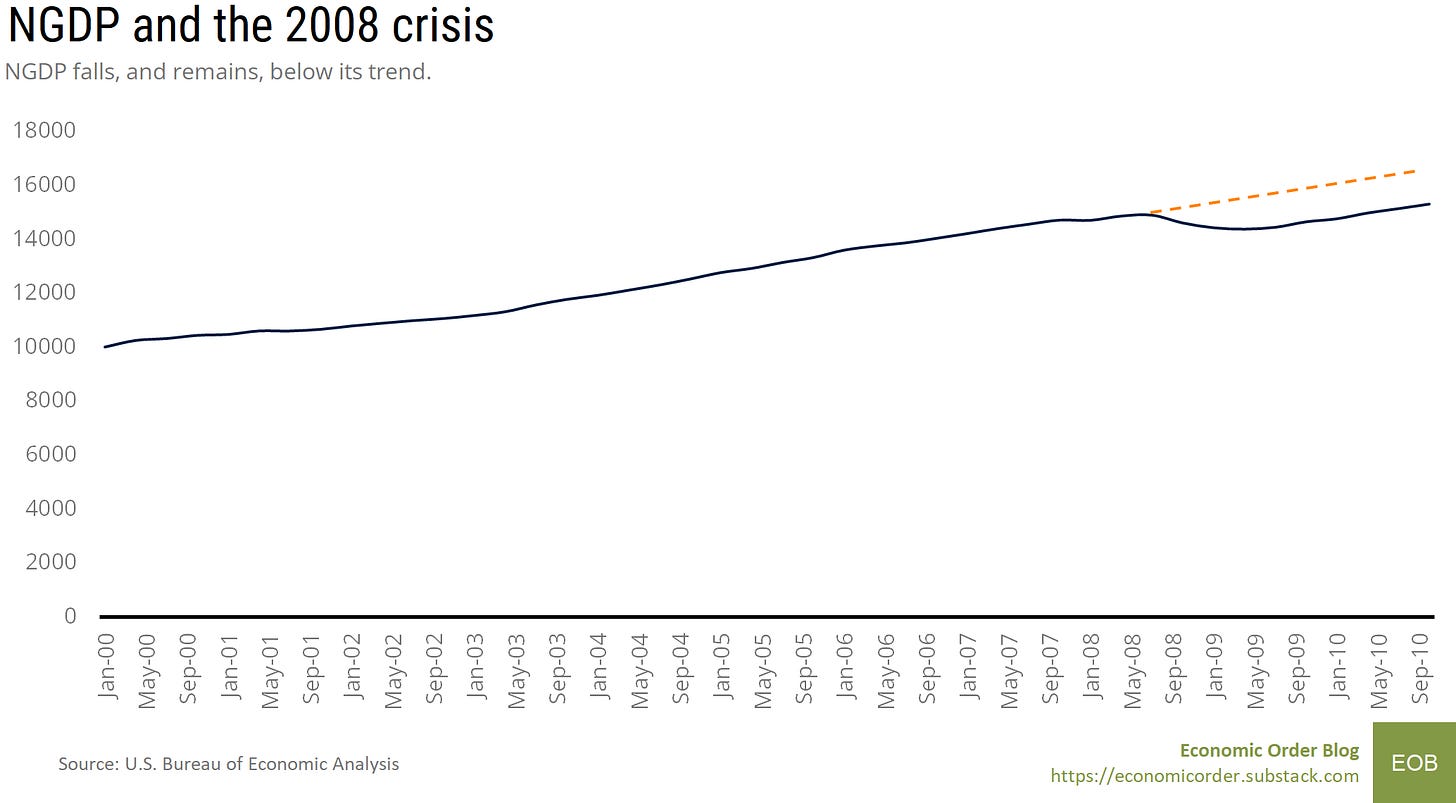

The following chart shows the evolution of NGDP (solid line), the NGDP trend (dashed line), and the NGDP gap (green bars measured on the right axis).

The plot shows the Fed committed to policy mistakes. The first one is letting NGDP fall below its trend in the first half of 2020. The second one is allowing NGDP to move above its trend starting in the second half of 2021.

Maybe this is the best the Fed could have done given all the policy uncertainty surrounding Covid-19. Unavaoidable or not, those mistakes are still costly. The public paid the cost of the first error in the form of a sharper fall in GDP than necessary. The cost of the second error is the current high rates of inflation.

There is a difference to note with the 2008 crisis. In that case, NGDP fell and remained below trend. The first error in both cases is the same, NGDP falling below its trend. But, the second error differs. In the case of the 2008 crisis, the error was not having NGDP go back to trend. With Covid-19, the error was an over-correction.

The Fed does not specify how they calculate that average inflation (last year, last five years, since AIT implementation?) It doesn’t matter; the inflation rate is above the 2% target regardless of how the average inflation is calcualted.

Nicholas, you are being too strict by calling the pandemic-induced fall in NGDP in early 2020 the "first mistake". I provide an analysis by stage in my recent post. https://marcusnunes.substack.com/p/the-stages-of-the-pandemic-induced?s=w